List of services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

An Overview

Transport and Marketing Assistance (TMA) scheme is introduced by the Government of India for agricultural products. It aims to provide less expensive transportation of goods, referred to as freight, which is an integral element of today’s international trade. Under this scheme, the cost of transportation required to export some specific agricultural products has lowered. It essentially means that the Freight Cost up to a specific limit will be reimbursed by the Government to make our Agricultural products competitive in the global market. It also provides benefits for the marketing of agricultural products, which helps to promote the brands and help them attain the recognition for Indian agrarian products in the overseas markets. The TMA Scheme is included in the Foreign Trade Policy (2015-20) and was introduced on 01.03.2019.

TMA Scheme Eligibility – Who is eligible for TMA Scheme?

Eligible Products under the TMA scheme

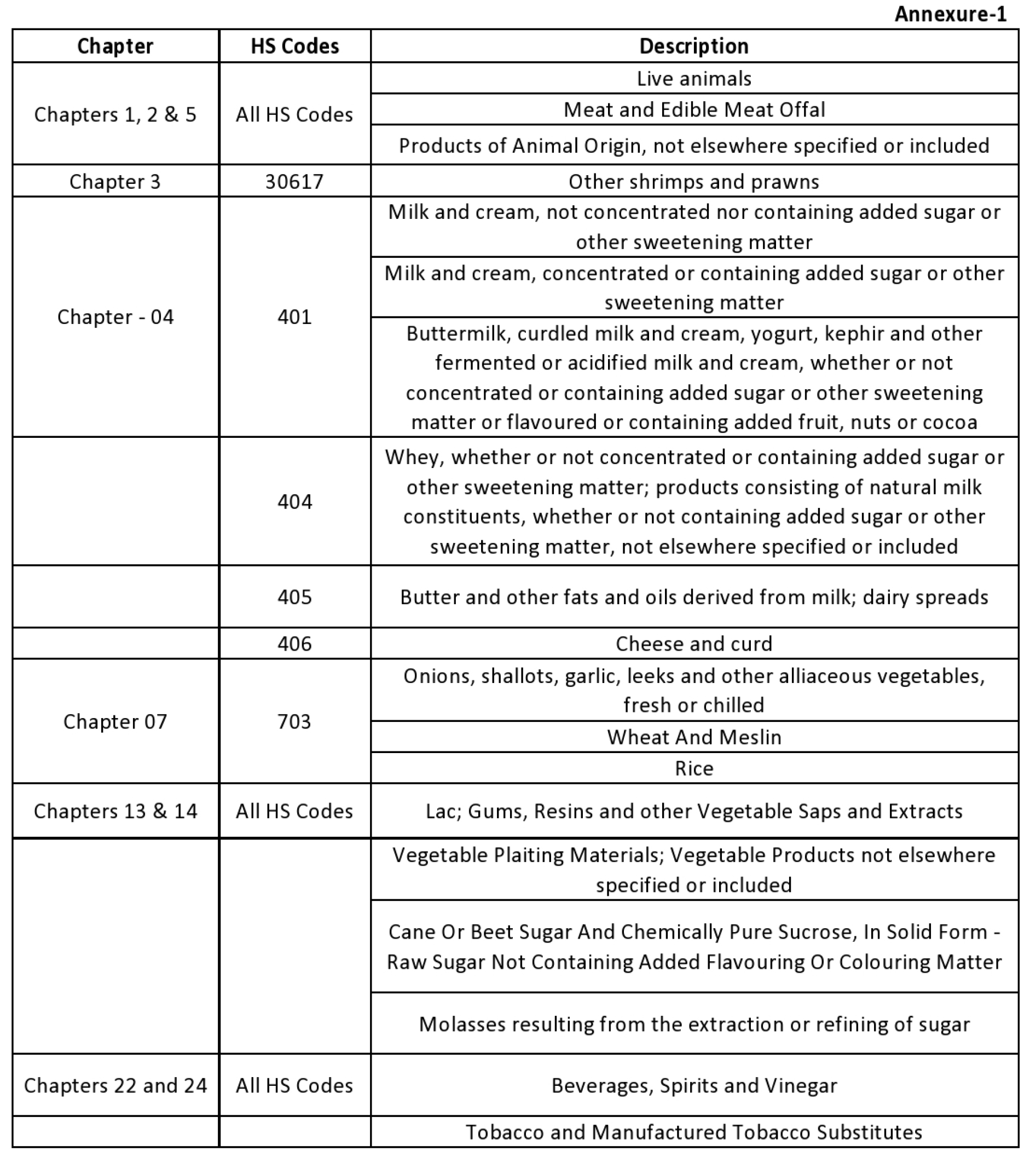

The scheme is eligible for all the export products covered under chapters 1 to 24 of the

ITC HS, including marine and plantation products.

However, some specific products falling under Chapter 1 to 24 would not be covered

under the Scheme for assistance. A list of such ineligible products is mentioned in

Annexure (1).

List of ineligible products under TMA scheme as given below:

Coverage under the TMA scheme

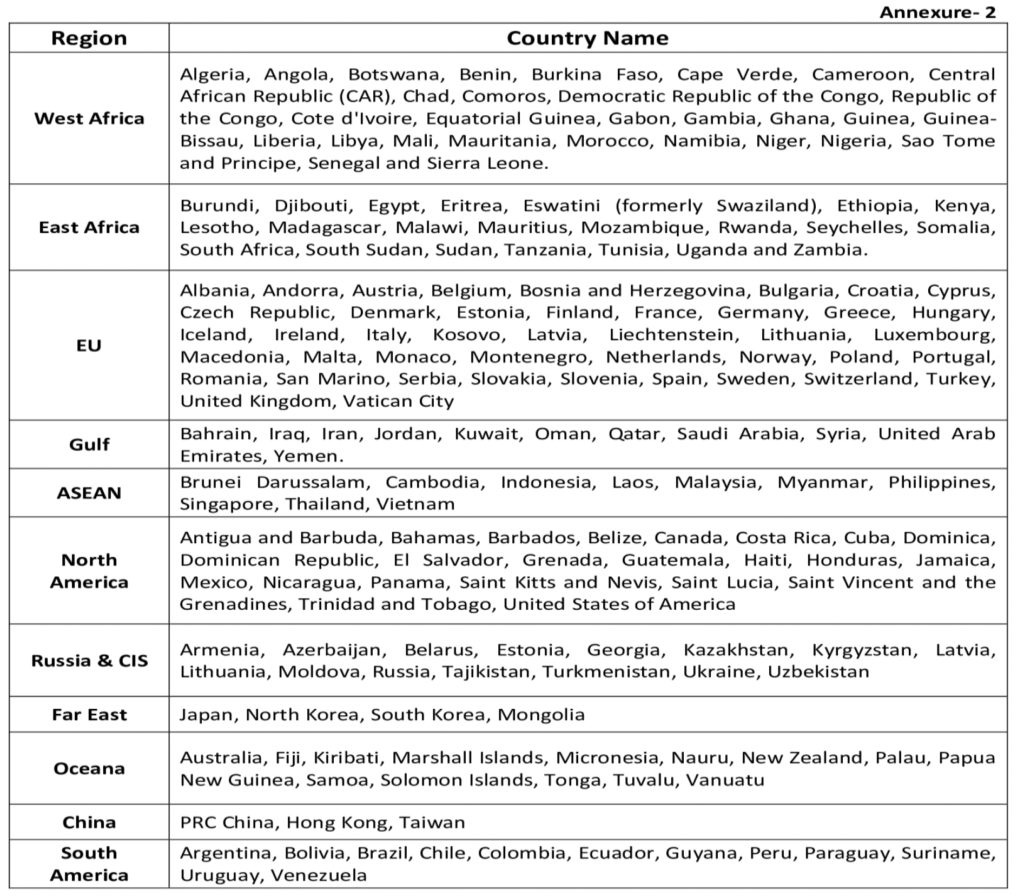

- Export of agricultural products, to certain permissible countries as specified in Annexure

(2) will only be covered under the TMA scheme. - The scheme covers freight transportation and the marketing for export through both ways,

i.e., Air as well by sea (both regular and refrigerated cargo). - Annexure- 2 mentioned a list of all the export destinations/countries in each region which

are available for assistance under the TMA Scheme. - In Annexure- 3 mentioned, the rate of assistance is provided Country-wise.

List of Regions and Export destinations/countries in each region eligible for assistance

under TMA are as under:

The assistance is provided as per the rates notified in Annexure-3.

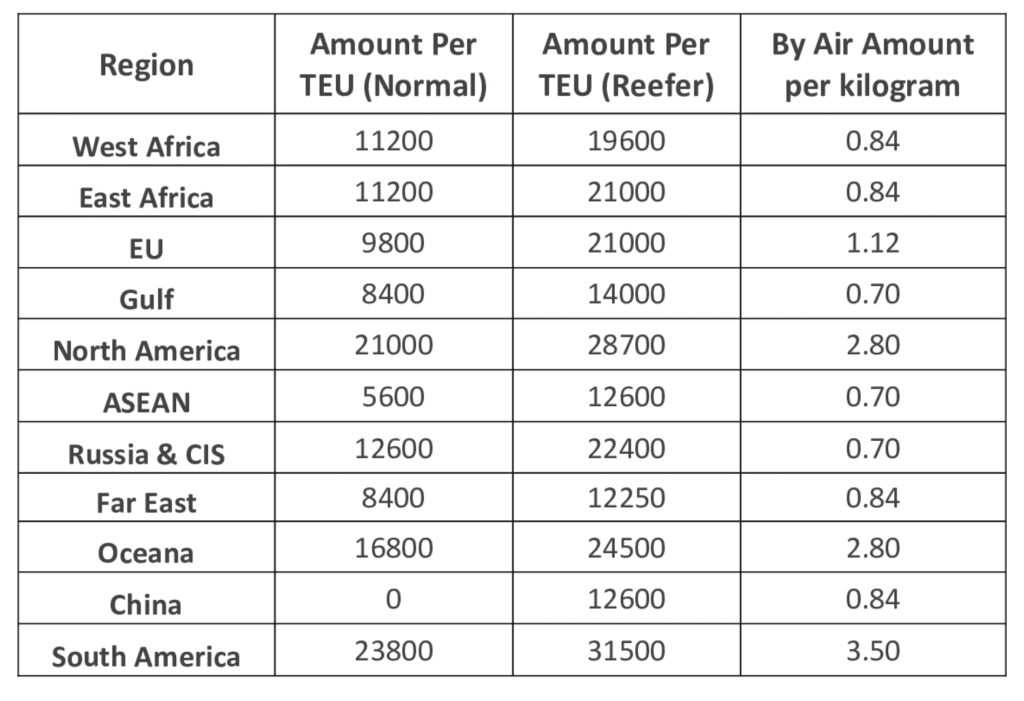

Transport and Marketing Assistance (TMA) Scheme Annexure (3)

Differential rate of assistance under TMA (Amount in Indian Rupees)

Applicability and Important terms and conditions covered under the TMA Scheme

Applicability under TMA Scheme

- It is essential to understand that the scheme would only be applicable for the period of 01.03.2019 to 31.03.2021. That means all the Export made within the given period will be eligible for the TMA scheme.

- This aid from the Government would make a significant impact on the agriculture markets of specific products.

Important Terms & Conditions under the TMA Scheme

- The TMA scheme covers the Shipping cost based on the freight paid for Twenty-feet Equivalent Unit (TEU) containers.

- The TMA benefit will not be provided for the LCL containers, i.e., less than the container load and for a vessel that has both, eligible and ineligible cargo. TMA will not be applicable where the cargo is shipped in bulk or break-bulk mode.

- It is important to acknowledge; a forty-foot container will be considered as two TEUs (Twenty-Foot Equivalent Unit).

- The benefit in export products which are exported through the air, the assistance would be based on per kilogram.

- The assistance would only be provided under one condition, that the payment for exports is received in Foreign Exchange through normal banking channels only.

- Only the exports made through EDI ports are permissible under the scheme.

- Nature of Assistance under TMA scheme - Assistance under the scheme will be provided in cash through a direct bank transfer as a part of reimbursement of freight paid by the exporter.

- The scheme suggests that in FOB supplies, where the Indian exporter pays no freight, such exports would not be covered under this scheme.

Ineligible categories under the TMA Scheme

The below are the ineligible categories under TMA scheme:-

- Products exported from SEZs/ EOUs/ EHTPs/ STPs/ BTPs/ FTWZs

- SEZ/EOU/EHTPs/STPs/BTPs/FTWZs products exported through DTA units

- Export of imported goods covered under paragraph 2.46 of the FTP;

- Exports through trans-shipment, i.e., exports that are originating in the third country but trans-shipped through India;

- Exported items are restricted or prohibited for export under Schedule-2 of Export Policy in ITC (HS) unless specifically notified.

- Export of goods through courier or foreign post offices using e-Commerce

Documents required for claiming benefit under the TMA Scheme

For an online application under the Transport and marketing Assistance (TMA) Scheme, below is the complete updated list (2020) of all the documents required for the TMA application.

- Import Export Code (IEC Code)

- Registration-Cum-Membership-Certificate (RCMC)

- Shipping Bill Copy

- E-BRC

- Commercial Invoice

- Bill of Lading, in case of Shipment by Sea

- Airway Bill, in case of Shipment by Air

- TMA Application Form- ANF- 7 (Part- A & Part- B)

- Certificate of Chartered Accountant (C.A.)/ Cost and Works Accountant (ICWA)/ Company Secretary (C.S) as per Annexure A to ANF- 7(A)A

- Pre-receipt.

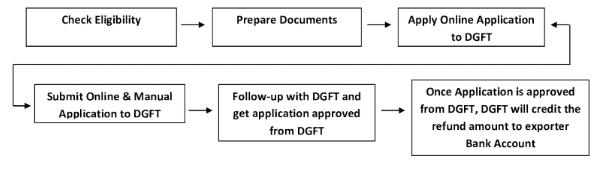

Procedure to apply under TMA scheme – How to apply under TMA scheme for Exporters?

- The Application has to filed by registered exporter having valid RCMC.

- The applicant has to Choose option of “RA’s” headed by Additional DGFT while making 1st application, and there would be no changes allowed for further claims.

- Applicants have to make an application on a quarterly basis within one year from the completion of a quarter in a single bunch. There are no late cut provisions applicable for this scheme.

- The Shipping bills, E-BRC's, Bill of Lading, and CA Certificate are the documents required for physical submission.

- The applicant has to submit a physical PDF copy of ANF 7(A) A with prescribed documents, and it has to be filed manually with RA within 30 days.

- The Non-submission of a physical copy of the application with prescribed documents within 30 days after filing online application, the incomplete or deficient application shall result in non-acceptance; therefore, the application shall be rejected.

- Public notice 02/2015-20 Dated 13th April 2020, DGFT has given one-time relaxation for submission of physical documents. As per the public notice, the application filed online on or after 01.02.2020 upto 30.09.2020, physical copy of ANF- 7(A) A along with prescribed documents can be submitted manually to DGFT RA upto 30.10.2020.

How can we assist you in claiming TMA Scheme benefits?

We are leading Import Export (DGFT Consultants) having a client-base across India. We provide all the services related to DGFT, including MEIS, EPCG, SEIS, Advance Authorisation, DFIA, RoSCTL scheme, TMA scheme, RoDTEP scheme, etc.

While applying for the TMA application, the below table will help you to know the steps that how we can help you to claim TMA benefits.

- Step-1: We collect the documents from you like Shipping bills copies, E-BRC’s, Commercial Invoices, Bill of Lading, or Airway Bills Copies.

- Step-2: Our Team will work on the documents and prepare the online application.

- Step-3: After the preparation of the online application, the online copy will be mailed to you for confirmation.

- Step-4: Once the online application is approved from you, we will submit the online application. And will send you manual documents for signing purposes.

- Step-5: Once the Hard copy of documents is received from you, we will submit it at DGFT and take regular follow-up with DGFT.

- Step-6: Once DGFT approves the application, DGFT gives the Pre-receipt copy. We will share the print with you and take regular follow-up with DGFT till the benefit amount is credited to your account.

FAQ's

The Transport and Marketing assistance (TMA) scheme aims to reimburse the part amount of freight paid (sea and air) by the exporter and also the marketing costs involved in the promotion of the product. The scheme is available from 01.03.2019 to 31.03.2021 for the specified exported product under Chapter 1 to 24.

Merchandise Exports from India Scheme (MEIS) is the additional export incentive

scheme under which Credit Scrip or MEIS License is issued as a reward against eligible

exports.

The applicant can refer to Public Notice. 82/2015-20/ dated 29.03.2019 to check the TMA Scheme benefit. Or can simply share the documents with us, and our team would get back to you with an excel report of eligible benefit shipping bill wise.

The Applicant has to file an online application at http://dgft.gov.in. The TMA application will be made on a quarterly basis.

Applicant has to create an online application on a quarterly basis at DGFT Site. The claim is available on the CIF Shipments basis. There are no late cut provisions applicable for this scheme. We can simplify the application process for you with the help of our in-house TMA scheme experts.

Applicant has to pay online Government fees of Rupees 1,000/- for each application.

After submission of Manual Application, DGFT RA may check application, and DGFT may approve the application within 15 to 30 days. Once DGFT approves the application and if Fund will be available with DGFT, then payment will be credited immediately to the exporter account, or if the funds are not available with DGFT, then RA will issue the Pre-receipt letter. Once payment is available with DGFT, then the refund will be credited to the exporter account.

The applicant needs to apply for claim within one year from the completion of the quarter. For Example: if export was made in quarter January to March 2020, the claim should be filed by 31.03.2021.

Why Afleo Consultants?

- 100+ TMA Applications filed: We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- Social Media Presence: We wish to get every opportunity to grow our relationships with our clients and for which we made our presence on each social networking sites to update them about the latest Notifications, Circulars, Amendment done in foreign trade policies.

- 24/7 Telephonic Service: We believe in offering better and faster services to our clients who can't afford to wait until the morning for a problem to be fixed we are just a phone call away, they just need to call or drop a mail and we try to reach them as soon as possible.

- Aggressive Follow-up: We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in getting TMA scheme benefits from DGFT without delay.

Recent Updates

- Public Notice No. 05/2015-20, Dated 12th May 2020:-

The above public notice is for the procedure for availing transport and marketing assistance (TMA) on Specified agriculture products - Air shipments claims should be made on per kilogram basis.

- Public Notice No. 02/2015-20, Dated 13th April 2020:-

The above public notice is for relaxation for submission of physical documents of application due to COVID-19 pandemic.

Fill the below form to get in touch with us

Insights

- Restricted Import License for Laptops, Tablets, Personal Computers, Servers etc. February 12, 2024

- IGST Refund on Exports – All you need to know February 12, 2024

- EPR Targets under Plastic Waste Management Rules October 10, 2023

- Export Import [EXIM] Business Weekly Updates – General News | New Notifications | 28 Aug to 24 Sep 2023 September 26, 2023

- Export Obligation Period [EOP/EO] Extension under EPCG Scheme | COVID Relaxations, Process, Fees etc. September 12, 2023

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.