List of services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

An Overview

The cabinet of India approved the RoSCTL Scheme to rebate all state and central taxes for garments and made-ups by replacing the previous scheme Rebate of State Levies, which provides only rebates of state taxes. The RoSCTL Scheme came into effect from 07/03/2019.

As we know, the USA has filed a complaint against India at the World Trade Organization (WTO). The complaint is that the Indian government gives undue benefits to Indian Exporter under export subsidies like the MEIS scheme, and it is against the WTO rules. Therefore, the Rebate of State and Central Taxes and Levies (RoSCTL) Scheme is a new scheme introduced by the Ministry of Commerce. Currently, RoSCTL scheme is only valid for garments and made-ups (i.e., Chapter 61, 62 & 63). Further, this scheme would be extended to all sectors.

As per Public Notice No. 58/2015-20 Dated 29.01.2020, Merchandise Exports from India Scheme (MEIS) has also been withdrawn for Export items falling under Chapter- 61, 62 & 63, w.e.f, 07.03.2019.

Rebates under the RoSCTL scheme

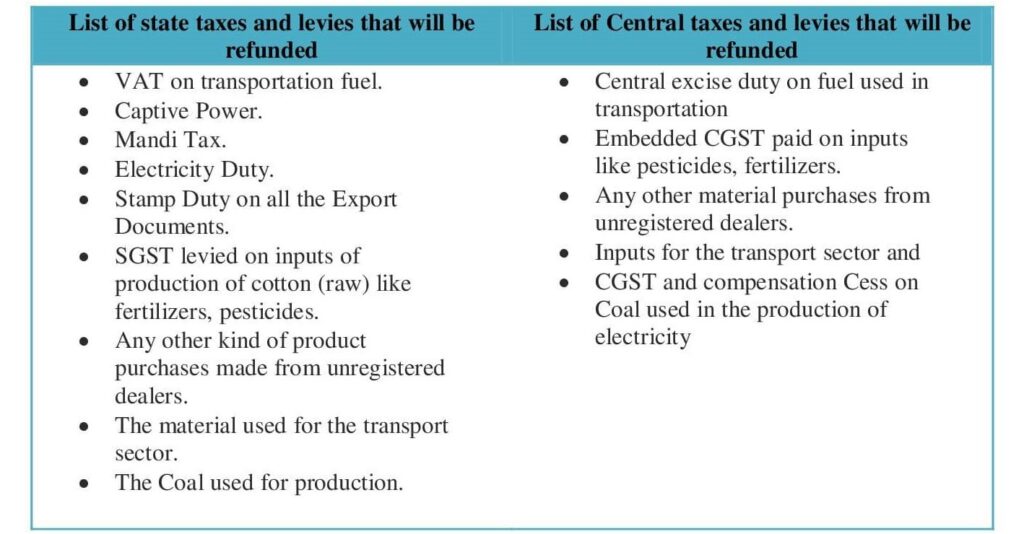

The RoSCTL Scheme gives rebate of the state and central taxes. Please find below list of state taxes and levies that will be refunded along with a List of central taxes and levies that will be refunded under the RoSCTL scheme DGFT.

RoSCTL Scheme Rates

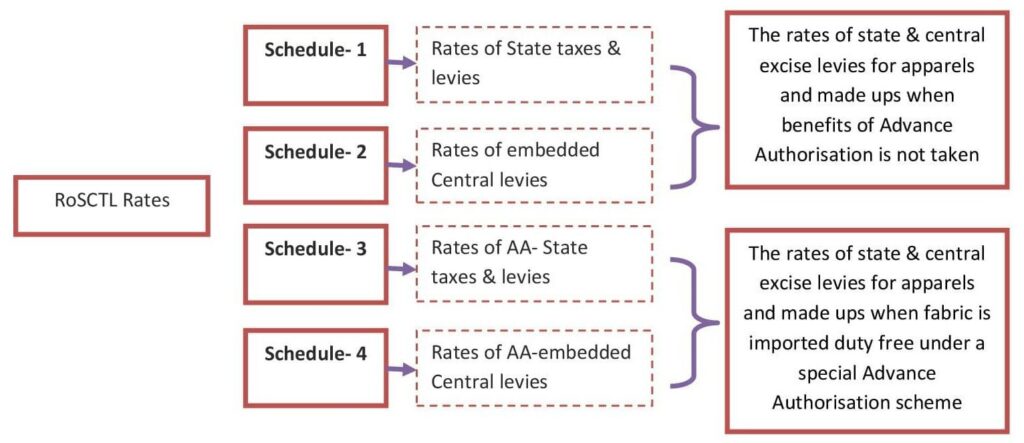

As per Notification No. 14/26/2016-IT (Vol.II) dated 07.03.2019, the RoSCTL rates have been notified as schedule 1, 2, 3 & 4 as follows:-

Schedule 1 & 2 - The rates of state & central excise Levies for apparels and made-ups.

Schedule 3 & 4 - The State & central excise Levies rates for apparels export when the fabric is imported duty-free under a special Advance authorization scheme.

The RoSCTL Rates are given as follows:-

What is additional ad-hoc Incentive under RoSCTL Scheme DGFT?

The Ministry of textile (MoT) has announced an additional AD-HOC Incentive of 1% on Free-On-board Value (FOB).

The additional Adhoc Incentive is calculated by the difference between new rebate on State and central taxes and levies scheme and the old rebate on State levies (RoSL) and Merchandise Exports from India Scheme (MEIS).

The additional incentive upto 1% is given only when the benefits received in RoSCTL is lesser than the combine benefit received in RoSL and MEIS. The Benefit is calculated on FOB value of shipping bill.

The period to claim the additional Adhoc Incentive is from 07th march 2019 to 31st December 2019.

How is the benefit given under the RoSCTL scheme?

Previously under the Rebate of State Levies (RoSL) scheme, the Rebate was directly credited into the Exporter bank account as notified by the Ministry of textiles same as Duty Drawback.

However, the benefit under the new RoSCTL scheme along with additional ad-hoc incentive is given in the form of duty credit scrips same as MEIS scrips. The RoSCTL scrips will be freely transferable in nature.

Just Like MEIS scrips, RoSCTL licenses can be used for payment of Import duties or can be sold in the open market at a premium rate.

Documents required to apply for RoSCTL Scheme

Below documents are required, to process the online application for RoSCTL scheme:

- Shipping Bill Copy

- DGFT Digital Signature

- Valid RCMC (Registration Cum Membership Certificate)

While applying online application, the Applicant has to make separate online applications for:

- S.B’s having Let export date between 7th March 2019 and 31st December 2019

- S.B’s having Let export date after 1st January 2020 Till 31st March 2020

As per new Public Notice No. 58/ 2015-2020 DT. 29.01.2020, please Note the Last Date of filing of an application for Duty Scrips under RoSCTL scheme will be:

- For shipping bills with Let export date between 7th March 2019 and 31st December 2019, the last date of filling online application is 30.06.2020.

- For shipping bills with Let export date from 1st January 2020 till 31st March 2020, the last date for filing an online application will be within one year from the date of Let Export Date.

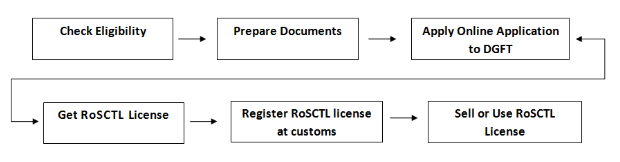

Procedure to apply for RoSCTL scheme:

The RoSCTL Scheme came into effect on 7th March 2019. To claim the benefits application shall be done on the DGFT Portal of the shipping bills till 31st December 2021.

As per the latest advisory from the Government various changes have been done in the system to implement the RoSCTL scheme w.e.f. 1st October 2021.

Procedure to avail the benefits from DGFT

- The Applicant has to fill an online application using a digital signature.

- Linking of E-BRC’s is not required for applying the RoSCTL application.

- 50 shipping bills would be allowed in 1 application.

- As per Para, 3.09 (HBP) Facility of split scrips is available.

- The Applicant can choose the port of registration for EDI ports from where export is made.

- Separate applications to be made for EDI and non EDI ports.

- If the Applicant is under DEL (Denied Entities List) list, he/she can’t make an application.

- The Applicant can apply within one year from the date of uploading of the shipping bills from ICE Gate to DGFT server. Any application filed beyond this period would be time-barred as no late cut provisions are applicable.

- RoSCTL Licenses will be valid for 24 months from the date of issue.

Procedure to avail the benefits from ICE Gate Portal

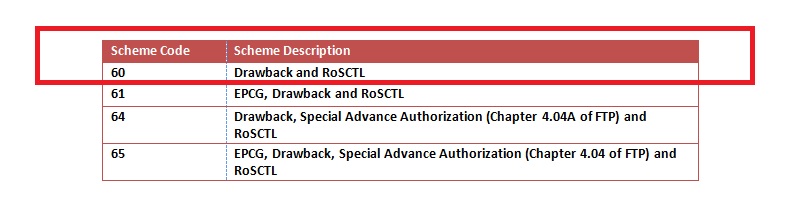

To avail of the benefits under the RoSCTL Scheme, the claim has to be made by the exporter in the EDI shipping bill by using specific scheme codes.

The options for the RoSCTL scheme are being provided with separate scheme-code as listed below -

Some Important Points to note about RoSCTL scheme

- The rebate under the RoSCTL scheme is allowed subject to the condition that foreign remittance for the shipment made will be realized in stipulated time frame as per FEMA.

- If the sales proceeds are not realized within time allowed, then all the RoSCTL scheme benefits must be returned with 15% annual interest.

- All the original export documents along with shipping bills are required to be maintained by the exporter for a period of 3 years from the date of issuance of RoSCTL scrips.

- If the applicant fails to submit all the original documents asked by the licensing authority, then he/she will be liable to return entire benefit with applicable interest.

How can we assist you in claiming benefits under the RoSCTL scheme?

We assist our clients in the preparation of documents in providing hassle-free services.

- Prepare and submit online applications to obtain the License under the RoSCTL scheme.

- Registration of the License done in custom from our office.

- We also assist in the selling of licenses, provide help in documentation for the transfer of a license to the buyer.

- Also, do the online transfer by recording the details on the DGFT website.

- Consult our clients about the benefits they can avail of on their products and the country in which they export.

FAQ's

The Rebate of State and Central Taxes and Levies (RoSCTL) Scheme is an export Incentive scheme introduced from 07th March 2019 to 31.03.2020 for those who export Apparels and made-ups from India. The RoSCTL Scheme gives duty credit transferable and sellable scrips on the FOB value of export.

The Rebate of State and Central Taxes and Levies (RoSCTL) Scheme was introduced from 07.03.2019, and the Exporter can get the benefit upto 31.03.2024.

Applicant has to file the online application form ANF-4R by using a digital signature on the DGFT website at http://dgft.gov.in to the concerned regional authority of DGFT.

The Rebate of State and Central Taxes and Levies (RoSCTL) Scheme is valid upto 31st March 2024.

The RoSCTL Scheme has replaced the existing Merchandise export from India scheme (MEIS Scheme) & RoSL scheme.

The Rebate of State Levies (RoSL) Scheme is eligible for the textile sector to increase competitiveness in the global market and to create employment opportunities in India. This scheme gives a rebate of State Levies (RoSL) from customs. And it was directly credited to the Exporter bank account. This scheme was applicable only till 06.03.2019.

The difference between RoSL & RoSCTL Scheme is that under RoSL Scheme, there is no benefit on the central tax and Levies. But in the RoSCTL scheme, the Exporter will get rebate of both State and Central tax and Levies from DGFT.

Yes. MEIS scheme benefit has been withdrawn for items of apparel and made-ups, i.e., Chapter 61, 62 & 63, w.e.f. 07th March 2019.

No, both can not be claimed simultaneously.

Yes. The Exporter is eligible for RoSCTL Scheme. The Exporter can get RoSCTL DGFT benefit after deducting the MEIS benefit amount.

No, Linking of E-BRCs is not required for applying under RoSCTL Scheme.

The DGFT RA may issue RoSCTL scrip without E-BRC, but in future, if foreign remittance is not received. Then the authorization holder has to pay rebate amount along with interest to concerned DGFT RA.

RoSCTL scrips can be utilized by saving basic custom duty while importing of goods or authorization holder can sell the RoSCTL license at market rate. We can help you to sell the license at the best market rate.

There is no government fee required for claiming the benefits under RoSCTL Scheme.

After submitting the online application at DGFT, it will take 2 or 3 days to process the online RoSCTL license.

The time limit for filing the RoSCTL application is within one year from the LEO date of the shipping bill.

There is no late cut provision under RoSCTL Scheme. The Exporter has to apply within one year from the date of shipping bill; otherwise, the shipping will be time-barred and no RoSCTL scheme benefit will be granted.

Once the RoSCTL license is issued from DGFT, the authorization holder has to register the license at customs. We can help you to register the license within 1 or 2 working days.

Yes. It is mandatory to register the scrips at customs. We can help you to register your license at customs.

Yes. RoSCTL License is transferable. The license holder can use the license for Import or can sell the license. We can help you to sell the license at the best market rate.

Yes. If the Applicant is not importing any item against the RoSCTL license, then the authorization holder can sell the RoSCTL license.

Yes. We can help you to sell of RoSCTL license at the best rate.

No. GST is not applicable to the sale of the RoSCTL license.

No. RoSCTL license cannot be used for the payment of IGST. It can be used against basic customs duty only.

The Applicant can transfer the RoSCTL scrip online by using the DGFT digital signature. Also, for transferring the RoSCTL scrip, the Applicant has to give a bill of supply (on Company letterhead) & Transfer letter (attested from the bank).

Once the license is issued from DGFT, the RoSCTL license is valid for 24 months from the date of issuance of the authorization.

No. The RoSCTL Scrip should be utilized within the validity period, the Scrip can be considered as a Piece of Paper once the Validity gets expired and Revalidation of the Scrip shall not be permitted under the RoSCTL Scheme unless it has expired in the custody of any Govt. Authority.

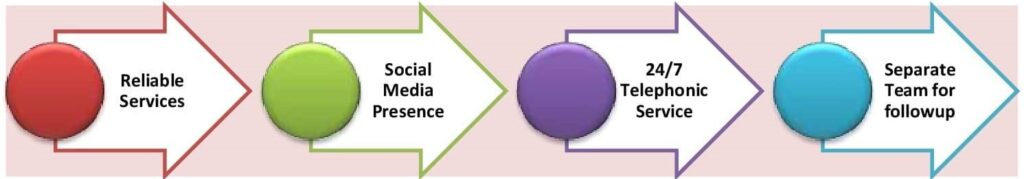

Why Afleo Consultants?

- Reliable services: We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- Social Media Presence: We wish to get every opportunity to grow our relationships with our clients and for which we made our presence on each social networking sites to update them about the latest Notifications, Circulars, Amendment done in foreign trade policies.

- 24/7 Telephonic Service: We believe in offering better and faster services to our clients who can't afford to wait until the morning for a problem to be fixed we are just a phone call away, they just need to call or drop a mail and we try to reach them as soon as possible.

- Separate team for follow-up: We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining RoDTEP licenses without delay.

Recent Updates

- 4th August 2021: Uploading of eBRC on DGFT website of the issued scrips under RoSCTL –

The All IEC holders who have been issued scrips under RoSCTL for shipping bills upto 31.03.2020 are requested to get the related e-BRC uploaded on DGFT Portal by their AD banks latest by 15.09.2021..

- 14th July 2021: Extension in ROSCTL Scheme for Garment Exporters –

The Cabinet extends RoSCTL scheme for textile exporters till March 2024.

- Public Notice No. 58/ 2015-2020 DT. 29.01.2020 –

The above public notice is for withdrawal of MEIS for items in the apparels and made-ups sector, amendment in Para 4.95 (HBP) 2015-20, and revision of the ANF- 4R for Implementation of RoSCTL Scheme.

- Public Notice No. 83/ 2015-2020 DT. 29.03.2019 –

As notified by the ministry of textile for issuance of scrip for RoSCTL, Additional provision under Hand book of procedures for implementation of the RoSCTL

- Notification No. 14/26/2016-IT DT. 08.03.2019 –

The notification is for rebate of state and central Embedded Taxes and Levies

Fill the below form to get in touch with us

Insights

- Restricted Import License for Laptops, Tablets, Personal Computers, Servers etc. February 12, 2024

- IGST Refund on Exports – All you need to know February 12, 2024

- EPR Targets under Plastic Waste Management Rules October 10, 2023

- Export Import [EXIM] Business Weekly Updates – General News | New Notifications | 28 Aug to 24 Sep 2023 September 26, 2023

- Export Obligation Period [EOP/EO] Extension under EPCG Scheme | COVID Relaxations, Process, Fees etc. September 12, 2023

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.