List of services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Overview

In one line, the Export Promotion Capital Goods Scheme (EPCG Scheme) can be

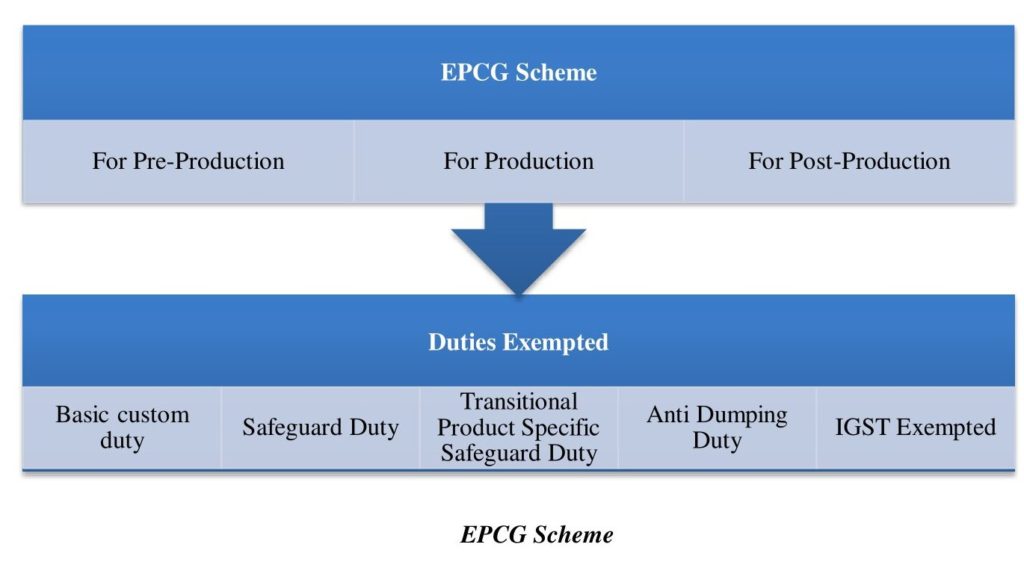

explained as “Duty-Free (Zero Customs Duty) Import of Capital Goods/Machinery for the manufacture of products meant for Export.” The Capital Goods may be used for production, pre-production & post-production stages of goods. This scheme is also known as zero duty EPCG scheme. We are all well aware of the heavy custom duties companies have to pay on the Capital machinery imported for the production requirements, due to which businessmen usually do not import them and compromise with the quality of the goods. The higher the price of the Machinery used to be, the higher the custom duty was, and this functionality started affecting the competitiveness and quality of manufacturing industries deeply. To improve this situation, The Government of India came up with a scheme where it was allowed to import capital goods at zero customs duty. EPCG Scheme was introduced by the Government of India to facilitate the Import of Capital Goods/Machinery for producing high-quality goods and services. The main aim of the EPCG Scheme is to improve India’s competitiveness in the manufacturing sector.

Under the EPCG Scheme, below are the Type of Capital Goods / Machinery eligible for Import

- All the capital goods, including semi-knocked down and complete, knocked down conditioned goods.

- All the software and computer systems included in the capital goods that are imported.

- Moulds, spares, jigs, dies, tools, fixtures, and refractories.

- Catalysts for initial charge along with one subsequent charge.

As per para 9.08 of FTP 2015-20, “Capital Goods” are defined as “any plant, machinery, equipment or accessories required for manufacture or production, either directly or indirectly, of goods or for rendering services, including those required for replacement, modernization, technological up-gradation or expansion. It includes packaging machinery and equipment, refrigeration equipment, power generating sets, machine tools, equipment, and instruments for testing, research and development, quality, and pollution control. Capital goods may be for use in manufacturing, mining, agriculture, aquaculture, animal husbandry, floriculture, horticulture, pisciculture, poultry, sericulture, and viticulture as well as for use in the services sector.”

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy to understand manner. It Explains What is EPCG Scheme and it’s application process; details about Export obligation & Redemption of EPCG License; entire summary and step by step procedures involved in the EPCG scheme.

What is the benefit of EPCG License, and who can apply for the EPCG scheme?

The main benefit of the EPCG Scheme is importing capital goods with zero customs duty.

- Eligibility Criteria for applying under EPCG Scheme-

Benefits under EPCG Scheme can be applied by any Exporter irrespective of his turnover. EPCG License can be issued to the following category of Exporters:- Manufacturer Exporter.

- Merchant Exporter with a supporting manufacturer.

- Service Provider (who is exporting services) For Example. Hotel Industry.

- Duties Exempted under EPCG Scheme-

Capital Goods under EPCG Scheme can be imported at zero customs duty. However, it must be noted that IGST and Compensation cess is exempted only up to 31.03.2021. The Government may extend the date through a notification issued from time to time. Capital Goods under EPCG Scheme can also be procured from indigenous sources (i.e., from domestic suppliers). In such cases, applicable GST for the supply would be exempted. - Indigenous Sourcing of Capital Goods-

The Exporter can also indigenously procure capital goods from a domestic manufacturer. Such domestic manufacturers shall be eligible for deemed export benefits under paragraph 7.03 of FTP.

EPCG scheme for Manufacturer Exporters

Manufacturer Exporter is eligible to apply for EPCG License. But Capital Goods imported under EPCG scheme comes with an actual user condition till the export obligation is completed. It means that the capital goods cannot be sold or transferred until the obligation is completed.

EPCG scheme for Merchant Exporters

Merchant Exporter tied with supporting manufacturer is eligible to apply for EPCG License. Supporting Manufacturer’s Name and his factory address where the capital goods are proposed to be installed should be endorsed on the EPCG License. Merchant exporter while discharging his export obligation should indicate the name & address of supporting manufacturer in all his shipping documents i.e. Shipping bill, Custom Invoice etc.

EPCG scheme for Service Providers

The Service provider is also eligible to apply for EPCG License. Various service exporters can take EPCG License to reduce capital cost. Service Exporter like Hotels, Tour Operators, Taxi Operators, Logistics Companies, Construction Companies can utilize the EPCG Scheme by importing / procuring domestically capital goods duty-free.

Export Obligation under EPCG scheme

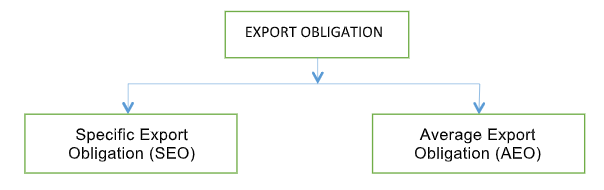

Export Obligation under EPCG Scheme is of two types i.e. Average Export Obligation & Specific Export Obligation.

Export obligation under EPCG Scheme

- Export Obligation under EPCG Scheme should only be fulfilled by the export of goods manufactured from the Imported/Domestically procured Machinery.

- What is the Average Export Obligation under EPCG scheme? – It is the most important of the two export obligation under the EPCG Scheme. It basically means that the Average turnover maintained in the past 3 years before obtaining the license should be maintained for each FY until the specific export obligation is completed. It is imposed with a view that after upgradation and induction of new machinery, the overall export should not fall below the past average of turnover achieved i.e., there should be a rise in the export turnover with the help of new machinery. It is to be maintained over and above the specific export obligation.

- What is Specific Export Obligation under EPCG scheme? – Goods manufactured from the imported machinery to be exported worth 6 times of the duties, taxes, and cess saved on the capital goods within 6 years from the date of issue of EPCG Authorization. In the case of indigenous sourcing of Capital Goods, specific EO shall be 25% less than the above Export Obligation.

- If the required Export Obligation is not fulfilled in 6 years, one extension of 2 years can be obtained, based on case to case basis. If the EPCG Authorization holder fails to achieve the Export Obligation (even after extension), the Organisation has to pay all the Custom Duties, Cess, taxes, saved plus 15% annual interest to the Customs Authority.

- The Export obligation can be fulfilled by direct exports, deemed exports, supply to SEZ, EOU Units, etc., Third Party exports, service exports in case of service providers.

Note: If the EPCG License holder intends to pay the IGST & Compensation cess while importing, then the net duty saved amount would be reduced accordingly, which will, in turn, reduce the obligation. However, this facility can only be availed on the condition that tax credit of IGST will not be taken by the Exporter.

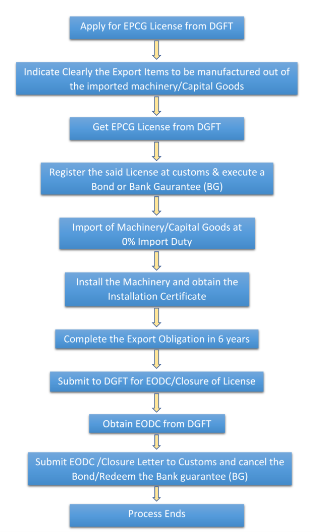

EPCG License procedure – How the EPCG Scheme works?

The Following image shows the whole process an organization has to go through to claim the benefits under the EPCG Scheme.

EPCG Procedure Flow Chart

- Import of Capital Goods has to be completed within 18 months of obtaining the EPCG License. The Revalidation of EPCG Authorization will not be permitted.

- At the time of Import, a bond or bank guarantee has to be executed with customs authorities, as per applicable provisions.

- After the Installation of the Capital Goods, it is mandatory to obtain the installation Certificate of the imported Machinery by an independent Chartered Engineer, and the same has to be submitted to DGFT.

- In order to incentivize fast-track exporters, if 75% of Specific Export obligation & 100% average export obligation is fulfilled in half or less than half of the export obligation period, than the remaining obligation shall be condoned and the EPCG License shall be closed by the concerned authorities.

- After completion of export obligation, a redemption letter has to be obtained from the concerned regional authority of DGFT.

How to apply for an EPCG License online?

The Applicant should submit an online application to DGFT to get EPCG License.

Please find steps below:

- Visit the DGFT Official Website- www.dgft.gov.in

- Login with DSC -> Select Services -> Online E-com Application

- Click on EPCG (0%)

- Fill all the details and upload the necessary documents.

- Kindly note that the following important points to be noted to make sure the documents are prepared error-free:

- IEC/RCMC should show the applicant as a manufacturer exporter.

- IEC/RCMC should have the address where the machine is proposed to be

installed. - MSME/SSI/Manufacturing proof should have the export products listed in the EPCG License.

- After filling all the details, submit the application.

- After a successful application, DGFT will issue the EPCG License.

Documents required to obtain EPCG license from DGFT.

The following documents will be required for EPCG Online Application:

- Pro forma Invoice/Purchase order of the Capital Goods/Machinery.

- Copy of IEC, RCMC, MSME & Central excise registration & GST Certificate.

- Details of Capital Goods sought to be imported with HSN code/Name, Model Number, and Technical Description.

- List of Products to be exported using the above machinery with HSN code.

- Chartered Engineer Certificate showing the nexus between the Capital Goods and the products to be exported.

- CA Certificate indicating the last three financial year turnover in USD & INR only for the above mentioned Export Products.

- Factory Address where the machine will be installed.

- Stepwise Process/Flow Chart indicating the stages where the capital goods are to be used.

- End-use of Capital Goods for Export products and stage where and how to be used. (Detailed Explanation)

How can we assist you with EPCG scheme?

Our experts assist you in getting EPCG Scheme Benefits from DGFT & Customs as under:

- First of all, we explain you about the terms and conditions of the EPCG scheme with respect to export obligation, so that you don’t default in the future and make a well informed decision.

- We help you in preparing documents for application of EPCG License.

- Obtaining EPCG License from Director General of Foreign Trade.

- Guiding regarding the procedural requirement & Compliances to be followed by the Client after issuance of EPCG Authorization.

- Obtaining Amendment, Revalidation or EOP Extension for the EPCG License.

- Getting Redemption Letter from DGFT RA and release of Bond/BG after fulfilling the export obligation from Customs.

FAQ’s

In EPCG Scheme, the exporter can import capital goods duty free i.e. Zero custom duty and one has to export finished goods worth 6 times of the actual duty saved value in 6 years. The main goal of the EPCG Scheme is to improve India’s competitiveness in the manufacturing sector.

The duty free authorization issued by DGFT RA is called EPCG License. It is Non-transferable license. It is used to import duty free capital goods.

Zero duty EPCG Scheme allows import of capital goods for pre-production, post production and production at zero customs duty, subject to an export obligation equivalent to 6 times of actual imported duty-saved value in 6 years.

In order to obtain an EPCG License from DGFT, the primary requirement is to file an online application with the RA of DGFT with DSC. While applying online application all the necessary documents are required to be uploaded. We have an experience team who can help you in applying for EPCG License.

Maintenance of Average Export Obligation is a major problem in EPCG Cases which we come across regularly. Therefore If the Company is sure to achieve stable export orders in the years to come, then the EPCG Scheme is a very good option for them.

Yes, the Average Export Obligation imposed in such cases will be zero.

This scheme is beneficial for those Exporters who intend to pay all the duties in cash at the time of Import and after fulfilling an Export Obligation, then claim the benefit of duty-free in the form of Duty Credit Scrips.

On receiving the EPCG License from DGFT the next step would be to register the license at Customs. It is not possible to clear the machinery duty-free unless you register the license at the port where the consignment will arrive. License is registered to the port of customs as mentioned in the license.

Yes, it is mandatory to register EPCG License at customs.

Yes, we can amend the EPCG License and below are the details-

- If the Authorization holder has received the license but wanted to procure indigenously, the holder can amend the license and take an invalidation letter.

- Due to changes in contract or increase in the value of imported capital goods, there will be a change in CIF value so we can amend the license.

- Some time we are unable to import due to some or the other problem and the validity of import is going to expire so we can apply for revalidation of license.

- Sometimes we want to add a new export product in the EPCG License due to some or the other reason. In such cases also, an EPCG license can be amended and new export products can be added.

The following details should be mentioned in the shipping Bill to be counted in EPCG Scheme,

- EPCG License No. Should be mentioned in the shipping bill,

- Export Product with ITC HS code mentioned in the shipping bill should be the same as on License.

Yes, Capital Goods/ machinery can be obtained from Domestic Suppliers with the help of an Invalidation Letter.

- Benefit to Domestic Supplier – he can claim the benefits of Deemed Exports against such supplies.

- Benefit to EPCG Authorization Holder – Specific Export Obligation will be decreased by 25% and such supplies will not attract GST until 31.03.2021. (Date may be extended from time to time).

Yes, we can calculate the shipping consisting of Advance Authorization/Duty Drawback/DFIA/MEIS No. to be counted in EO fulfillment only if EPCG license no. is mentioned. It means that the EPCG Scheme can be combined with any other export promotion scheme.

After obtaining an EPCG license from DGFT, it has to be registered at Customs. Once capital goods is cleared duty-free from Customs, it has to be installed at the said factory premises. An Installation Certificate has to be obtained from the Independent Chartered Engineer or Customs authority as a proof of Installation & commissioning. Once production starts, applicant should complete the export obligation in given time frame and submit all the export documents to DGFT office to close the EPCG license.

An EPCG Authorization holder needs to install the capital goods imported within a period of six months in front of an Independent Chartered Engineer. The chartered engineer will check that as per the authorization capital goods have been installed in given factory / supporting manufacturer premises or not and also cross verify the capital goods imported details with the license. And as per the verification, he will generate a certificate mentioning company name, Imported capital goods with quantity, BOE details, capital goods installation date on his letterhead with signed and stamped. The certificate generated by an Independent Chartered engineer is called the Installation Certificate. The same original copy should be submitted in DGFT and customs and receive the acknowledgment for the same.

Export Obligation is a task/job given by the DGFT to the applicant to export certain value of goods in certain time frame. Export obligation is mandatory to be fulfilled.

No, in the current Foreign Trade Policy 2015-21, there is no provision to fulfill export obligation through alternate products. Export Obligation will be completed only with those finished goods produced from imported capital goods mentioned in the EPCG License.

Yes, Deemed export is counted towards fulfillment of Export Obligation under EPCG Scheme. Supply to EOU/STP/EHTP/BTP Unit is called as deemed export and can be counted towards EO Fulfillment along with supply to SEZ units.

Yes, but in such cases Shipping Bill / Bill of Exports should contain the name of Third Party along with EPCG Authorization number.

In case of direct export, EO is calculated as 6 times of actual duty saved value. And in domestic sourcing, EO is calculated as 6 times of duty save value calculated as per notional custom duty on FOR Value.

Provisions for extension in the EO Period shall be governed as per the EPCG license issue date. For example, the EPCG License issued prior to the notification of FTP 2015-20 shall be governed by relevant provisions of HBP Vol 1 applicable at the time of issuance of EPCG Authorization. As per Current Policy in place – Yes, We can extend the Export Obligation period by two years after completion of 6 Years (6+2=8 Years). We can extend by paying a composition of 5% for the first year and 10% for the second year on the proportionate Duty saved value on pending / unfulfilled Export Obligation. But the minimum composition fee to be paid is Rs. 10,000/-. Alternatively, if the Exporter doesn’t want to pay the composition fees and has procured new export orders. He can enhance the EO by 10%/20% for the first/second-year respectively. In such cases, no composition fees will be required.

Further extension of EO after (6+2=8 Years) is difficult. You have to apply to the EPCG Committee at DGFT New Delhi for an extension. The extension can be granted of an additional 2 years in case of genuine hardships only.

If the authorization holder failed to fulfill the specific export obligation but maintained average export obligation, the holder has to pay proportionate Duty Saved Amount with 15% annual interest on pending specific export obligation on actual imported capital goods at customs and submit the proof of duty paid to license authority concerned.

If Average Export Obligation is not fulfilled, but Specific EO is fulfilled, Then Entire duty saved amount with 15% annual interest should be paid at Customs and submit the proof of duty paid to DGFT for regularization.

There are two types of Export Obligations – Average Export Obligation and Specific Export Obligation. We have to maintain both the obligation. While maintaining specific export obligations, we have to fulfill block-wise as per given below table and same we have to submit to DGFT.

| Period from thr date of issue of EPCG License | Minimum specific export obligation fulfilled |

| 1st Block(1st to 4th year) | 50% |

| 2nd Block(5th and 6th year) | Balance/ Pending Specific EO |

If the Authorization holder has fulfilled 100% Average Export Obligation each year from the issue of license and 75% or more of Specific Export Obligation in half or less than half of the original Export Obligations period, the holder can redeem the license as per para 5.09 FTP.

If the EPCG Scheme is availed for the below mentioned Export products, then the average export obligation will be exempted:

- Handicrafts,

- Handlooms,

- Cottage & Tiny sector

- Agriculture

- Aqua-culture (including Fisheries), Pisciculture,

- Animal husbandry,

- Floriculture & Horticulture,

- Poultry,

- Viticulture,

- Sericulture,

- Carpets,

- Coir, and

- Jute.

Apart from the exemption to the above sectors, relaxation is also provided to such sectors where the global growth rate has declined more than 5% for a particular FY.

The next step is to close the EPCG License and apply for redemption/Closure. We need to fill the redemption form ANF 5B along with the specified documents mentioned in the form and submit it with the original license at the DGFT RA for Closure.

EPCG Redemption or EPCG License closure procedure is a mechanism through which the DGFT monitors the fulfilment of the export obligation given to holder by the Government. We can help you in closure of EPCG License by preparing correct documents as per DGFT Rule.

The License holder has to fill the redemption form of ANF 5B with the relevant documents mentioned and submit to DGFT RA. The DGFT will issue a closure certificate called Export Obligation Discharge Certificate.

Yes, we do help in redemption of EPCG License.

We can surrender the EPCG License, if the holder does not want to import capital goods by submitting the relevant documents. We can help you in preparing and submitting the documents for surrender at DGFT.

No, EPCG License is non-transferable.

No, EPCG License is not possible to sell.

The import validity of EPCG License is 2 years and export validity of EPCG License is of 6years from the issue of license.

Why Afleo Consultants?

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- Social Media Presence: We wish to get every opportunity to grow our relationships with our clients and for which we made our presence on each social networking sites to update them about the latest Notifications, Circulars, Amendment done in foreign trade policies.

- 24/7 Telephonic Service: We believe in offering better and faster services to our clients who can't afford to wait until the morning for a problem to be fixed we are just a phone call away, they just need to call or drop a mail and we try to reach them as soon as possible.

- We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining & Closing EPCG licenses without delay.

Recent Updates

- Public Notice No. 01/2015-20 dated 07.04.2020-

As per the above public notice, one-time condonation under the EPCG Scheme-Extension till 31.03.2021 – Condonation given for Non-submission of Installation Certificate, Delay in filing application for EO Period Extension, etc.

- Trade Notice No. 20/2019-20 dated 26.06.2019-

As per the above trade notice, Issuance of Multiple Deficiency Letters and in Piecemeal manner during redemption of AA/EPCG is not allowed. DGFT officers will have to issue only one Deficiency letter covering all the errors at once.

Fill the below form to get in touch with us

Insights

- Restricted Import License for Laptops, Tablets, Personal Computers, Servers etc. February 12, 2024

- IGST Refund on Exports – All you need to know February 12, 2024

- EPR Targets under Plastic Waste Management Rules October 10, 2023

- Export Import [EXIM] Business Weekly Updates – General News | New Notifications | 28 Aug to 24 Sep 2023 September 26, 2023

- Export Obligation Period [EOP/EO] Extension under EPCG Scheme | COVID Relaxations, Process, Fees etc. September 12, 2023

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.